Council no longer accepts payments by cash or by cheque at our Administration Centre and other facilities.

Rates

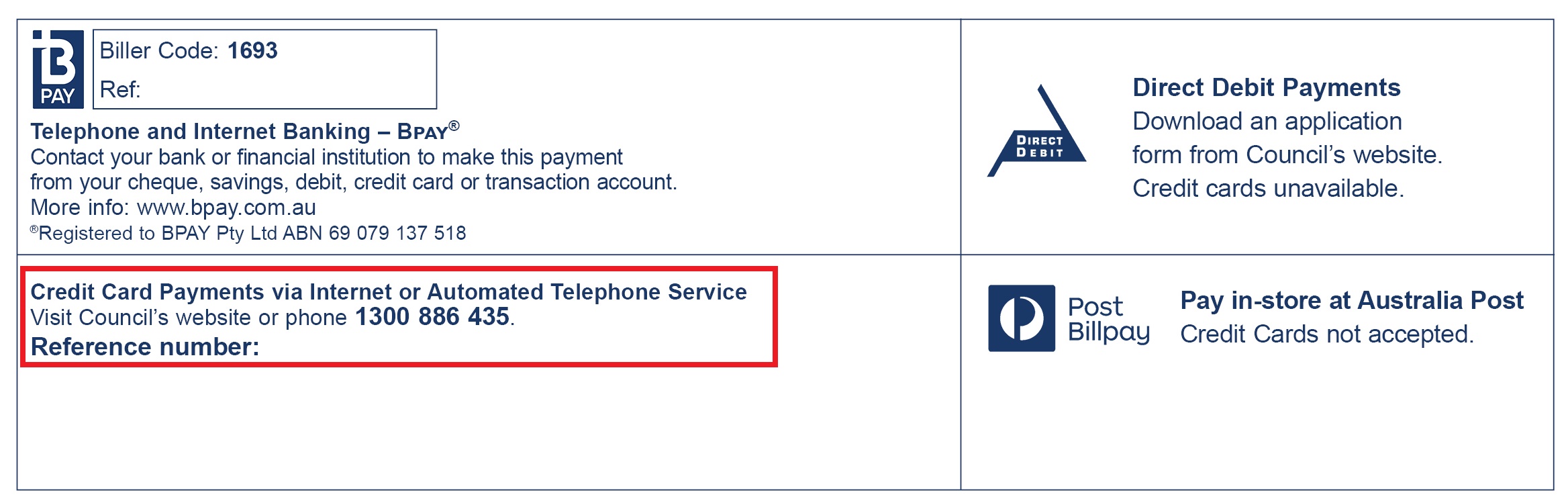

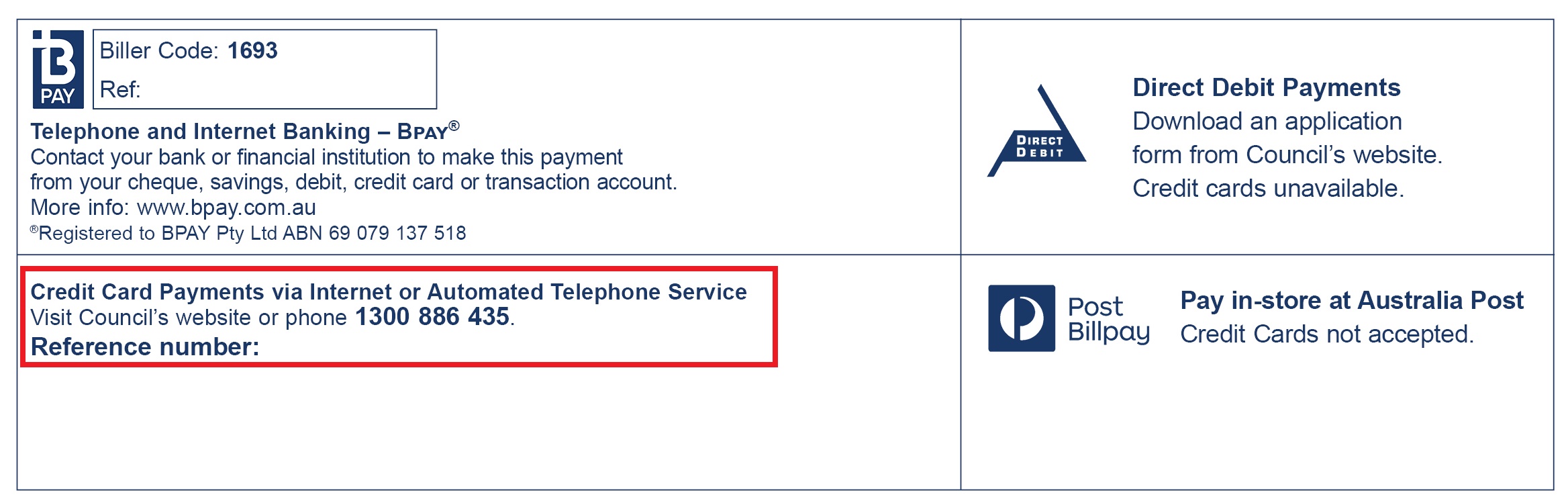

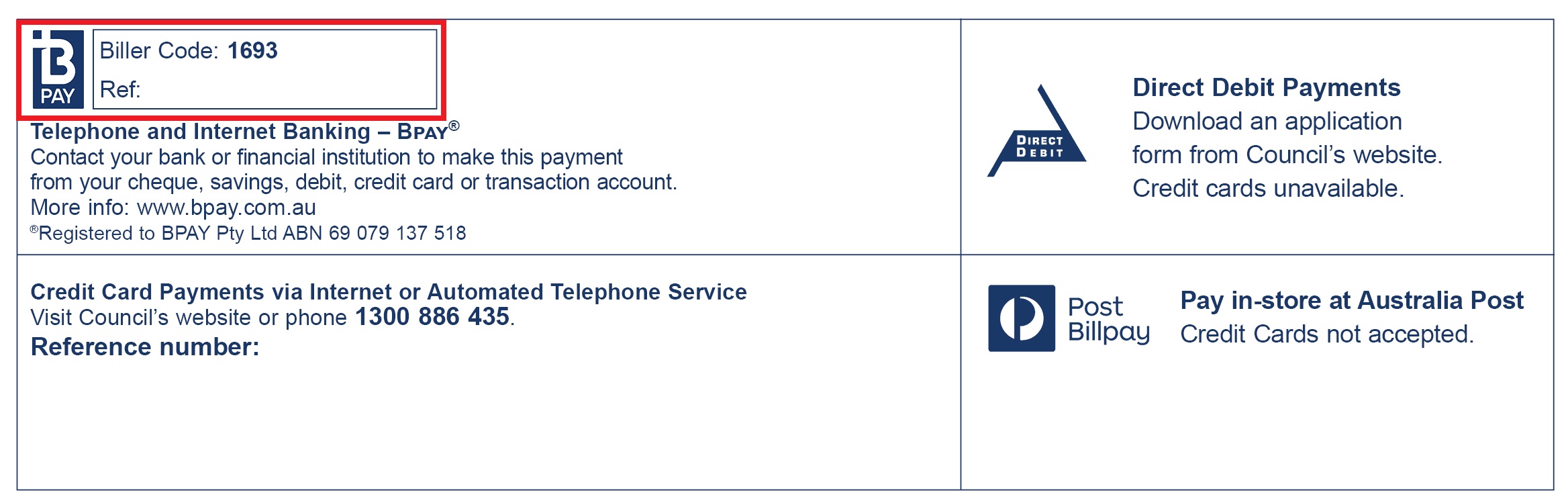

Pay your rates online This payment option is for rate notices only with Biller Code 1693.

There are several different ways to pay your rates.

Please note: There is no surcharge for credit card payments.

You will need your unique reference number that is located on the bottom of your rate notice.

Please note: There is no surcharge for credit card payments.

Pay your rates securely online via BPoint using Visa, MasterCard or American Express.

You will need your unique reference number that is located on the bottom of your rate notice.

Pay your rates over the phone on 1300 886 435 with Visa, MasterCard or American Express.

Pay your rates from your bank account or credit card via your financial institution. You will need to use the biller code: 1693 and the reference number on your rate notice.

Watch this short video on How to schedule your BPAY payment.

Note: we are unable to issue a tax invoice for BPAY payments - please use the bank issued transaction number as reference.

Complete a Direct debit request form to set up or change your bank account details for the payment of your rates.

You must:

- provide a bank account or debit form (not credit card)

Instalment notices will remind you when a payment is due for deduction from your account.

Return completed forms to us via:

- Email to ratesonline@ssc.nsw.gov.au

- Mail to Locked Bag 17, Sutherland, 1499

- In person at Sutherland Shire Council Administration Centre

4-20 Eton Street, Sutherland, NSW

Pay your rates in person at our Customer Service Centre located at 4-20 Eton Street, Sutherland, NSW. Accepted payment methods are Credit Card or eftpos only (no cash or cheque).

Take your rates notice to any Australia Post outlet.

Accepted payment methods are cash and some *cheques only (no Credit Cards).

*Changes to cheque services:

Australia Post has advised that cheques from some financial institutions will no longer be accepted for Council rate payments.

Cash payments for rates are still accepted.

Council no longer accepts payments by cash or by cheque at our Administration Centre and other facilities including our libraries, leisure centres and Hazelhurst Arts Centre.

The use of cash and some cheques for the payment of rates notices can still be made at any Australia Post outlet.

*Changes to cheque services:

Australia Post has advised that cheques from some financial institutions will no longer be accepted for Council rate payments.

Cash payments for rates are still accepted.

We have also removed merchant fees, so you will no longer have to pay them when you pay us using a credit card.

Please ensure you use the payment portal which corresponds to the Biller Code on your document.

Other payments

Pay your Tax Invoice online. This payment option is for tax invoices with Biller Code 565085.

Pay Tax Invoices relating to food business inspections, mobile food vendors, fire safety, skin penetration premise inspections, cooling towers and applications relating to development assessment and additional residential bins.

Pay your Tax Invoice online. This payment option is for tax invoices with Biller Code 69823.

Please read the information page before proceeding with your animal registration and payment.

Register and pay for your animal registration here.

Pay your Fine/Infringement Notice at Revenue NSW.

Find out more about Fine/Penalty Infringement Notices.

If you are experiencing difficulties paying your rates, please visit our Financial Hardships page.