The following rate information is effective 1 July 2024.

Rates

We provide a range of important services to our community. These services include community services, sporting and recreation services, environmental planning, public health, environmental protection and waste collection, treatment and disposal. The rates you pay allow us to fund these services.

If you wish to download a copy of your rate notice issued after 24 October 2023 you can do so at https://sutherlandshire.noticearchive.com.au/

Once registered you will receive an email where you will need to verify the email address and set up a password to finalise the registration. You will then be able to log in and view all rates notices.

Note: You must be the registered owner of the property as per the title deed or an authorised agent to obtain copies of the rate notice.

NOTICE: Effective from 12 October 2023 Sutherland Shire Council has changed the way you register to receive email rate notices.

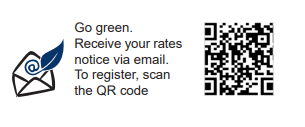

To receive your rate notice by email instead of mail, you can either:

Scan the QR code on the top right corner of your current (paper) rate notice and follow the links to complete the registration, or

Register online at registrations.pml.com.au/sutherlandshire. You will need information from your (paper) rate notice to be able to register.

Please note that if you are either:

- a new owner or

- have recently subdivided your property

you will need to receive a printed rate notice with a QR code located on the top right before being able to register.

If you are a new owner, it might take a few months to come in the mail.

Your rates notice will be sent from this email address: no-reply@ssc.nsw.gov.au. Please check your Junk Mail if you do not see it in your inbox and if necessary, add it to your list of safe senders.

Find out how to change your address, name or email information on your rates.

Your 2024/2025 Council rates effective from 1 July 2024

Council rates for 2024/2025 financial year have increased by the amount of 4.8% (this is the 'rate peg limit' for Sutherland Shire Council and is set by the NSW Independent Pricing and Regulatory Tribunal (IPART).

No, increases in total land values for the Sutherland Shire area do not mean that we can raise more money through rates. We are regulated by the NSW Government as to total rates income collected each year.

Council’s overall rating income since 2024/25 can only increase by the 4.8% rate peg, irrespective of significant underlying shifts in land value.

Your annual rate notice from Council shows a mix of ‘rate’ lines and ‘charge’ lines.

The 4.8% applies to rate lines only (e.g. Residential Rate). The rate line shown on your notice will change compared with last year.

The 4.8% does not apply to charges lines (Domestic Waste Management and Stormwater Management). These annual charges (and pension rebates) have not increased this year and remain the same as last year.

Eligible pensioners may be entitled to a rebate on their combined rates and charges. If you hold a blue Pensioner Concession Card and you own and live at your property, you can apply for a pensioner concession on your rates here.

We encourage ratepayers to meet their rate commitments as they fall due, but we’re also flexible and willing to discuss payment arrangements outside the normal instalment schedule.

If you are experiencing financial difficulties in paying rates, please contact us as soon as possible.

The valuation process is undertaken by the NSW Valuer General and is independent of Council. Land value is the value of only the land, and does not include buildings or improvements. The Valuer General’s website has a suite of tools and resources where owners can learn more about land valuations.

The NSW Valuer General gives new values to councils at least every three years. The land values determined by the Valuer General as at 1 July 2022 have been used to calculate the 2024/25 Sutherland Shire Council rates. These will also be used by Council to calculate rates for 2025/26.

The land valuation process is undertaken by the Valuer General (VG) and is independent of Council.

The Valuer General sent ratepayers a Notice of Valuation showing their 2022 land value. If you disagree with the land valuation applied to your property, you can enquire about making an objection via:

- Website valuergeneral.nsw.gov.au

- Email valuationenquiry@property.nsw.gov.au

- Phone via Service NSW on 1800 110 038 (Toll Free)

Your rates are calculated by multiplying your land valuation by a 'rate in the dollar' amount.

Your land valuation is provided by the NSW Valuer General. All properties in Sutherland Shire Council were revalued on 1 July 2022. These values will be used for rating for three financial years 2023-24, 2024-25 and 2025-26 (1 July 2023 – 30 June 2026).

The rate in the dollar for each rating category is set by us each year in our annual Operational Plan .

Your annual rates and charges are made up of three components: rates levy, stormwater management service and domestic waste service.

We also set a minimum rate each year. This means that if the result of your rate calculation does not reach a certain amount (minimum), then the amount of your rates will be equivalent to the minimum rate. In 2024/2025 the minimum rate for all properties is $1,049.15.

For example: If your land value multiplied by the rate in the dollar came in at $700, then you will be charged the minimum rate of $1,049.15 in 2024/2025.

We are Cashless

Council does not accept payments by cash or by cheque* at our administration centre and other facilities, including libraries, leisure centres, animal shelter, plant nursery and Hazelhurst Arts Centre. Please visit our We are Cashless page for more information.

Rates payments

There are several different ways to pay your rates. You will require your reference number located on the bottom of your rate notice. Please note, there is no Credit Card surcharge.

If you wish to pay your rates in full, they will be due on or before 31 August.

If you choose to pay quarterly, your payments are due by:

- 1st instalment: 31 August

- 2nd instalment: 30 November

- 3rd instalment: 28 February

- 4th instalment: 31 May

If you wish to pay by instalments, there is no additional cost.

Yes. Interest accrues on rates and annual charges that remain unpaid after the due date. In 2024-2025 the interest rate is 10.5% per annum, calculated daily.

We encourage all ratepayers to meet their rate commitments as they are due.

Should you be unable to pay by the due date, we encourage you get in touch and organise a flexible payment arrangement.

A flexible payment arrangement is designed to help ratepayers to make smaller, manageable payments more regularly.

If you are experiencing financial difficulties, please refer to our Financial Hardship page.

Other than extenuating circumstances, refunds will only be given upon request for rate accounts where all four (4) instalments and any arrears have been paid in full and the balance of the account is in credit for the applicable financial year.

A refund fee is applicable to issue a refund as per our fees and charges. The refund fee will be deducted from any balance refunded on your account.

To organise a refund, you need to provide:

- a copy of your receipt or bank statement

- your property address and/or property number

- the date and amount paid

- the method of payment used

- your EFT details including BSB and account number.

Rebates

To qualify as an eligible pensioner, you must own and live in the rateable property in Sutherland Shire and hold either a:

- Pension Concession Card,

- Veterans Affairs TPI or EDA Card, or

- Veterans Affairs Gold Card and receive income supplement support.

To find out further information visit our Pension concessions webpage.

Eligible aged pensioners may apply for the balance of their account to be paid when the property is sold, passed to estate or on termination of a pension concession card.

Calculating rates

Your rates are calculated by multiplying your land valuation by a 'rate in the dollar' amount.

Your land valuation is provided by the NSW Valuer General. All properties in Sutherland Shire Council were revalued on 1 July 2022. These values will be used for rating for three financial years 2023-24, 2024-25 and 2025-26 (1 July 2023 – 30 June 2026).

The rate in the dollar for each rating category is set by us each year in our annual Operational Plan .

Your annual rates and charges are made up of three components: rates levy, stormwater management service and domestic waste service.

We also set a minimum rate each year. This means that if the result of your rate calculation does not reach a certain amount (minimum), then the amount of your rates will be equivalent to the minimum rate. In 2024/2025 the minimum rate for all properties is $1,049.15.

For example: If your land value multiplied by the rate in the dollar came in at $700, then you will be charged the minimum rate of $1,049.15 in 2024/2025.

The Independent Pricing and Regulatory Tribunal NSW (IPART) has set the rate peg for 2024-25 at 4.8% for councils with no or negative population growth.

The rate peg | IPART is the maximum limit (presented as a percentage) that we are permitted to increase its income from rates.

A council can apply to IPART for a Special Variation to the rate peg which will be considered against the guidelines set by the NSW Office of Local Government.

Council has not applied for a Special Variation in 2024-2025.

Council’s rating structure contains the two primary categories of ordinary rate being:

- Residential

- Business

The rating structure for the business category includes a general business rate and 5 sub-categories.

Land has been categorised for rating purposes in accordance with sections 515 to 519 and 529 of the Local Government Act 1993. This category is based on how the property is used (not your land zone).

You can check your latest rates notice or the maps below to see what category your property falls under.

The rating category reflects the rating category of properties at a point in time. Rating categories for individual properties can change at any time.

Residential Rate

- 2024 OPERATIONAL PLAN 1

- 2024 OPERATIONAL PLAN 2

- 2024 OPERATIONAL PLAN 3

- 2024 OPERATIONAL PLAN 4

- 2024 OPERATIONAL PLAN 5

Business Ordinary Rate

- 2024 Operational plan 1

- 2024 Operational plan 2

- 2024 Operational plan 3

- 2024 Operational plan 4

- 2024 Operational plan 5

Miranda Core Major Shopping Complex Commercial Centre

Sylvania Southgate Commercial Centre

If you are not satisfied with the category given to your property, you may apply to us to have this reviewed. We will notify you of the outcome and reasons for our decision.

If you do not agree with the category given to your property following the review, you may appeal to the Land and Environment Court. You must do this within 30 days of receiving our review decision.

Council is legally required to levy an annual charge for the domestic waste management services for each parcel of rateable land for which the service is available. This charge is mandatory and includes the following waste services:

- free electronic waste collection events

- free household chemical collection events

- free waste education workshops

- two household clean up services per financial year

- waste provision for public events

- illegal dumping investigations and removal, and

- public place recycling bins.

Some parcels of land are exempt from rates and charges, including land within a national park or land that belongs to a school, charity or religious group and that is being used for those purposes. Unless you meet the exemption criteria outlined in the Local Government Act 1993, you are not exempt from paying rates.

Each year we update our Delivery Program that includes our Operational Plan These documents define how we plan to deliver services to the community for the next financial year and beyond. We encourage our community to review these documents during the exhibition period. If you have concerns, make a formal submission to ensure your feedback can be considered.

Land Values

The land value of your property is determined by the NSW Valuer General every 3 years. We are obliged by law to apply the latest land valuations.

A person has the opportunity to object to their land valuation within 60 days after receiving the Notice of Valuation, either online to the Valuer General online form or by phone 1800 110 038 to request an objection form.

While your objection is being reviewed, you are required to continue to pay your rates. If your objection is successful, the NSW Valuer General will adjust the value of your land.